2024-01-03 Market Musings

It is still hard to argue with bulls, but a "YOLO" Friday couldn't keep the SPX from another down week. One thing is for sure, being long large caps doesn't make you a contrarian to start 2025.

Intro

An odd week with the holiday, end of month, and end of year jammed in the middle. Between that and anemic volume (understandably) its probably wise to not read to much into how things went. That said here’s a brief pass at how the first week of 2025 ended.

Things to keep in mind

If you haven’t read the post below before (and I often revisit) it’s lessons I learned in 2024 and years prior

Price Action

“The only truth in markets”

SPX

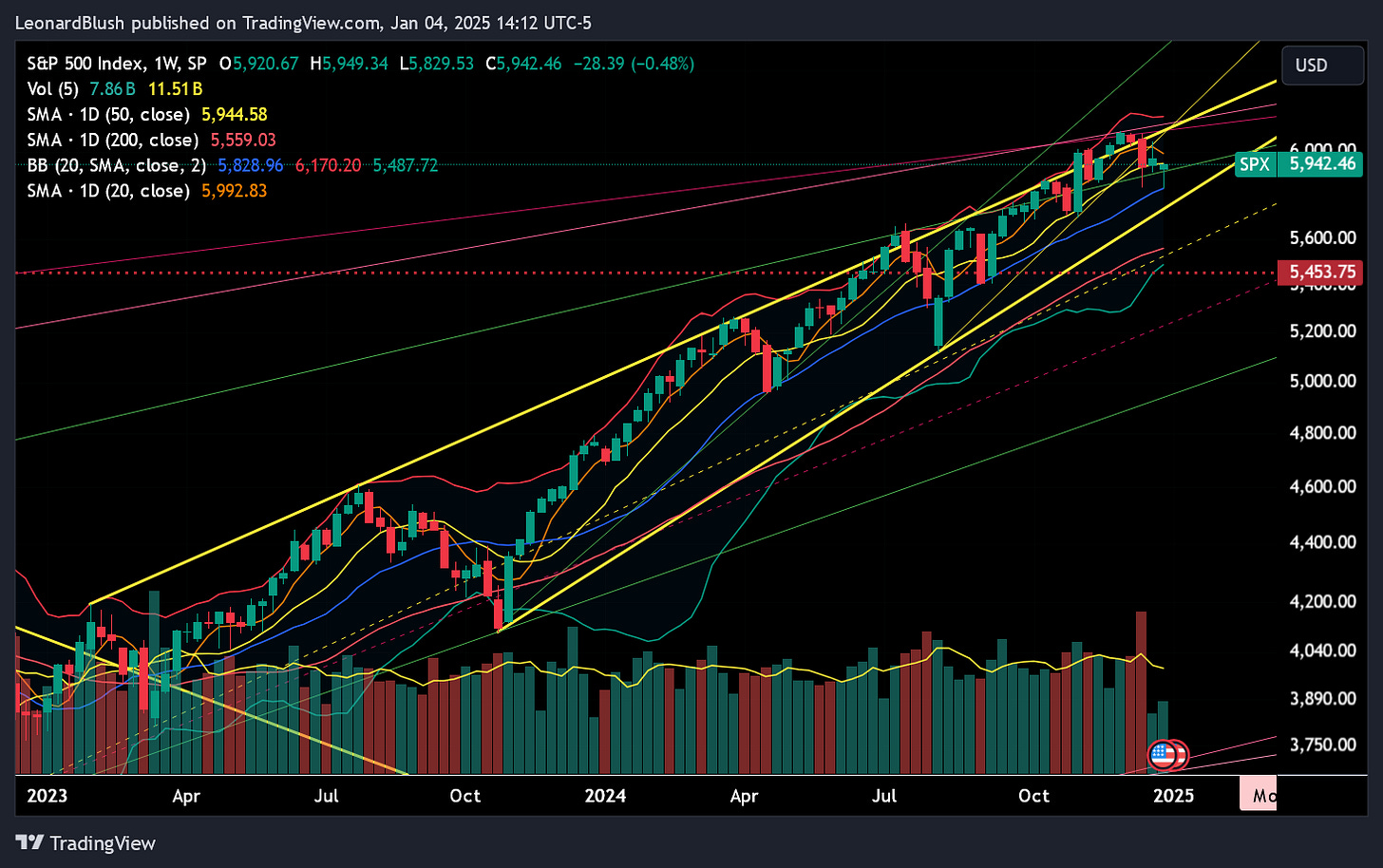

The Oct 23 to Apr 24 support trend line continues to act a as a safety blanket for bulls, but there’s solid arguments for a downtrend in the short term (below the 20 & 50 day MA, 20 day MA negative sloping with the 50 day MA near dead flat). As well we’re in a down trend according to the 3-bar rule for weekly candles. Low for the week landed right on the 20 week MA.

The equal weight index on the other hand, showing far more signs of wear.

And with the heart of the market (Nvidia) still “floundering” after a crazy two plus years, bulls should have some cause for concern.

US 10 Year

USTs took just the slightest breather from their decilne (yields up) this week but the upward momentum for yields hasn’t yet broken down. In an uptrend by all measures.

Oil Futures

I hit on this a week or so ago…what if Oil wakes up and takes inflation expectations, yields, and fed hawkishness with it.

The chart has more work to do, and obviously still in a long term wedge, but lots of green this week.

SPX Low Volatility/Headline Ratio

After the recession scare of August this ratio is stalling out before touching the summer lows. Something to keep an eye on if this turns back north (note the inflection points and dates below).

A few others….

Not been a vol sellers market for a bit.

And it shows…6 month VIX, still stugling to get lows to downtrend (and no there is not an election in 2025).

Is the Yen carry going to be a topic again soon? Back testing the multi-year trend….again.

But most importantly….a big week for fartcoin.

Market Structure

What’s beneath the surface….

Leonard’s Oscillators

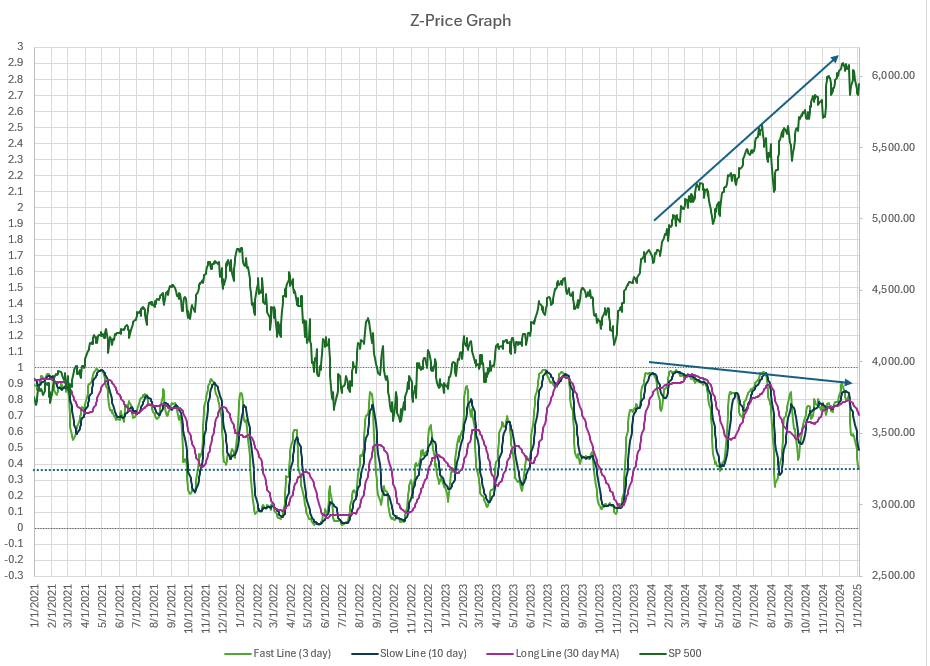

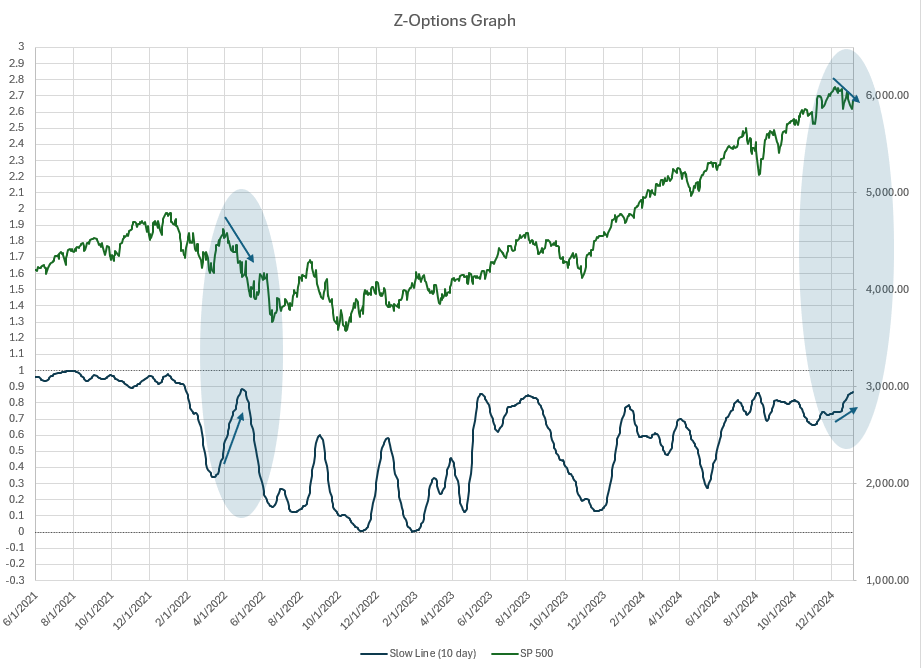

If it’s “number go up” that’s the milkshake that brings the boys to the yard, then currently only a cold glass of 2% is on offer. Price momentum challenging the lows since Oct 2023. Again, on the bulls to turn this around.

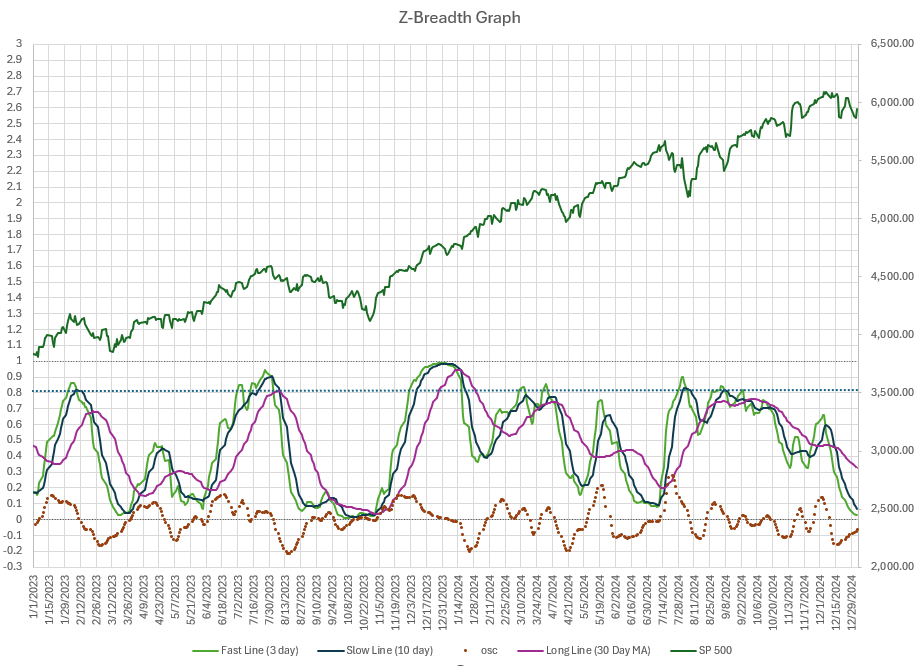

Breadth…basically zero. If you’re not Mag7 related you’re dead to the world.

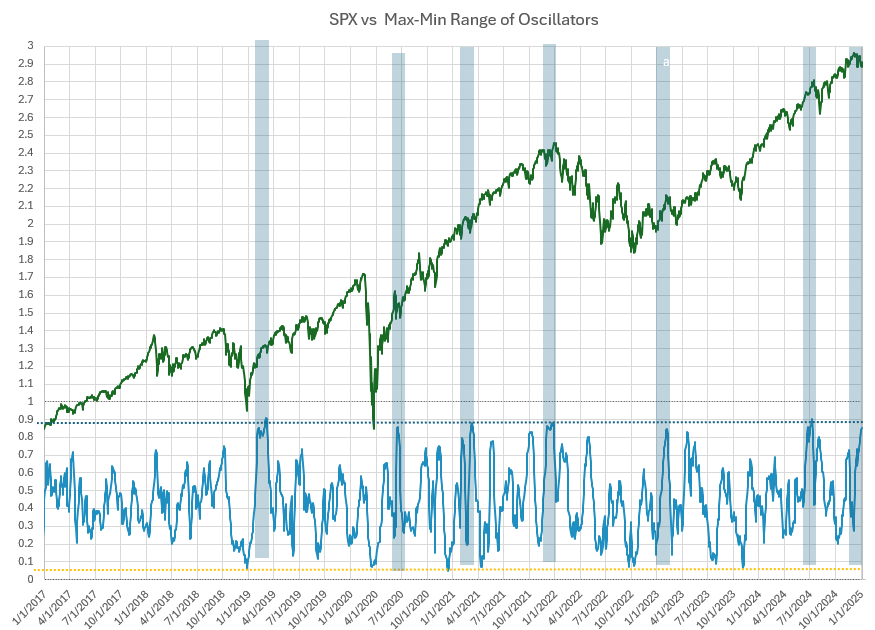

Unusual times for the dispersion of my indicators. Options saying “MOAR” breadth saying “please no'“ and yet another “rhyme” w/ December 2021.

Options Volume

However you want to say it, recent option flows have been uber supportive of prices. If there’s cause for concern on the bulls part, this should be it. All that leveraged option buying and we’re flat past 2-3 months on the headline.

These can continue higher (or lower) but for now the trend is backing away from froth territory.

Volatility

See above on the 6 month VIX and Shortvol futures. Haivng a relentless Vol selling crowd was the hallmark fo the post May 23 rally. So far that’s been nuedered.

“Fundamentals”

The things the market “should” care about and some of what it does care about.

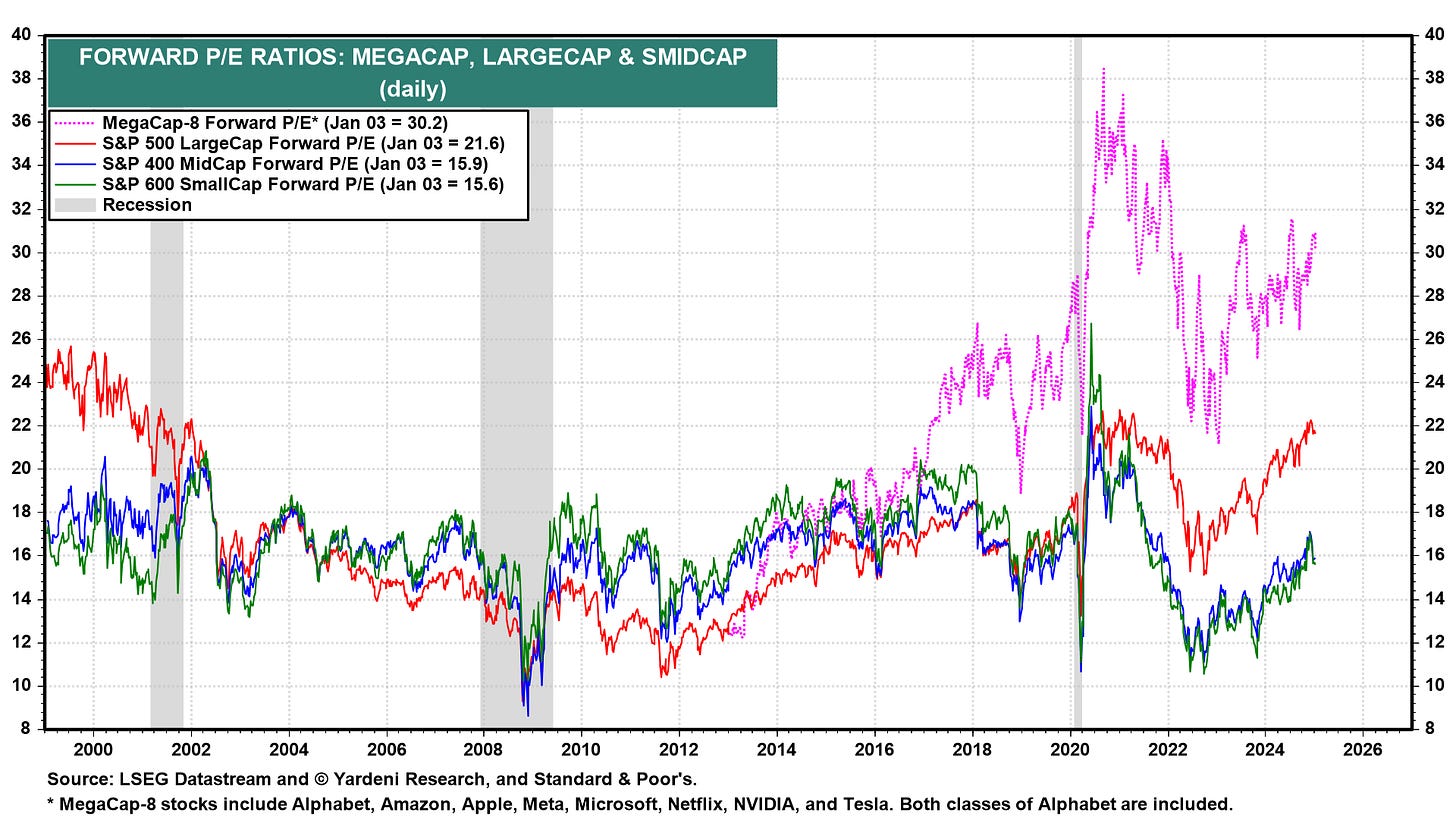

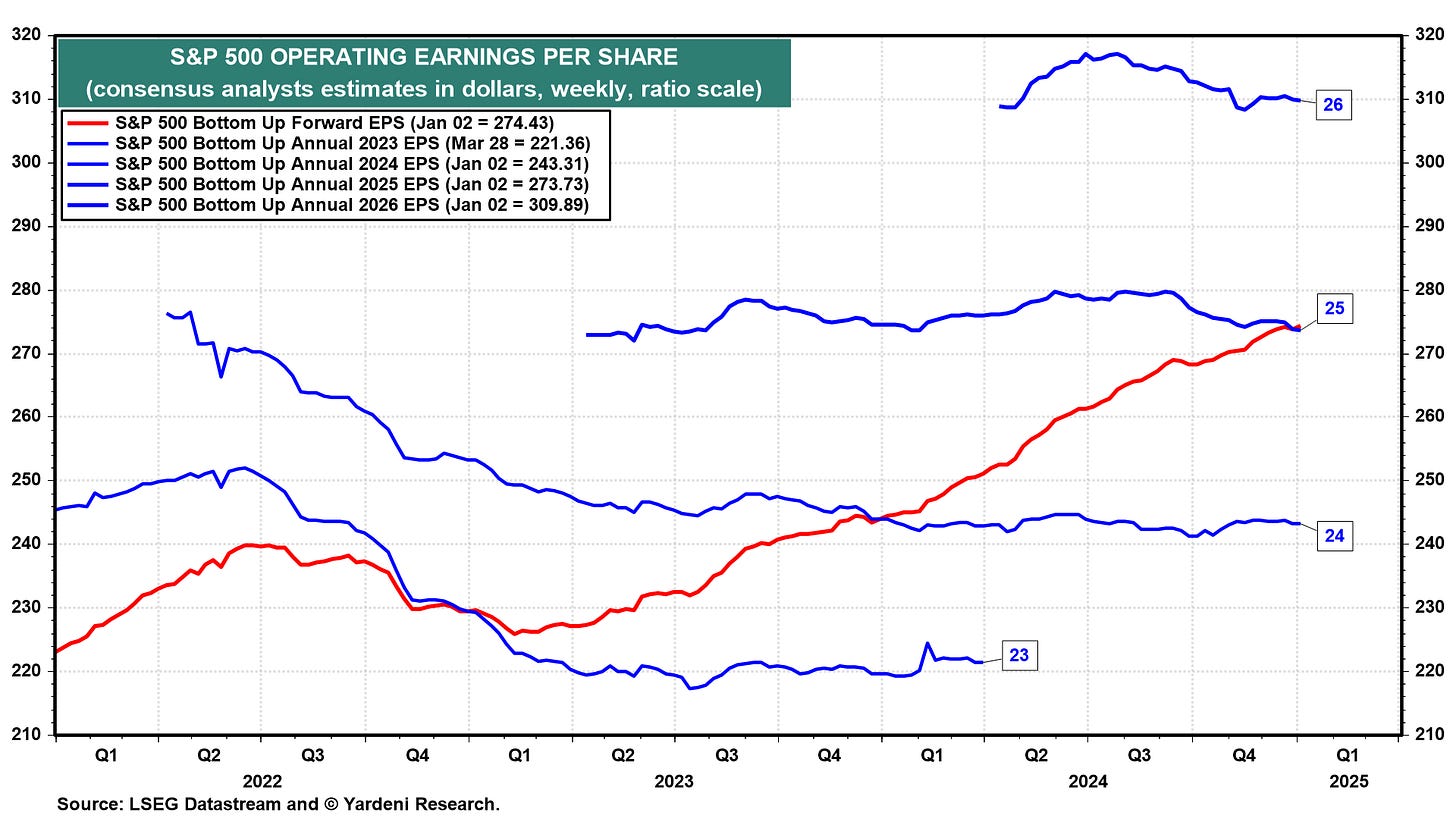

PE Ratios

Remaining (at least for large caps) somewhere in the stratoshpere, with EPS estimates for 25 & 26 both currently trending down.

Business Cycles - I.E. Demand

Economic data this week was much of the same. More edge of recession than 3%+ GDP. Jobless claims bouncing around (holiday) induced, and the market ignoring the weakest employment breadth component of the ISM Mfg index since 2008. NFP and all the government monkeying with numbers on tap this week we’ll see.

For now, beteween home builders heading south, auto inventories up, and no one expecting many rate cuts this year (rightly or wrongly) I remained concerned that we’ve used up the “past demand” that carried us the past few years.

Couple that with a measly 2% cost of living increase on gov’t transfers for 2025, and the 60/40 portfolio taking a hit in December and there’s cause for concern.

Now I know “Trump!” but it seems the only thing as unanimous as “trump will be good for the economy” is “what is Trump actually going to do?”

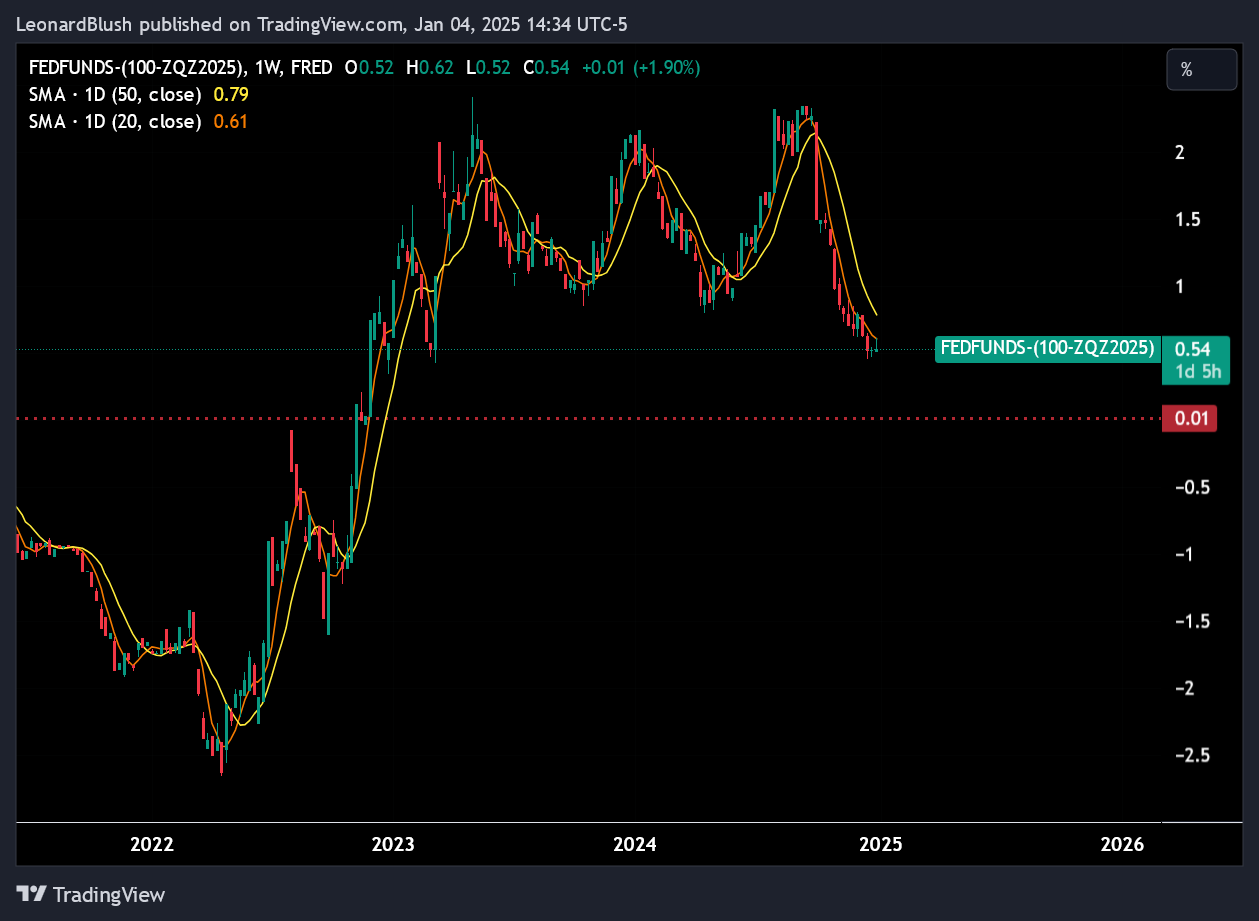

Rates

Expected Fed Cuts for 2025 & 2026 continue to dwindle. The markets may lose their shit if the below heads towards zero.

Current Sentiment & Narrative

There are still far more bulls than bears out there, and “AI”, “TRUMP”, “US Exceptionalism” is the table pounding you hear. The economy and labor market are “fine” and given crowds aren’t able to reason it’s going to take quite a clubbing over the head to tampen the underlying enthusiasm.

The more evolved are pointing that an invetiable (if true?) decline in interest rates on the longer end will fuel equities as past recent episodes. We shall see, it’s not clear to me equities are marching quite in (opposite) lock-step with UST yields as they’ve done in the past.

Flows

Where $ is “sloshing to and from”

Bonds vs Stocks

Neither had a great December (worst month for the 60/40 since April down some 2.5%). Perhaps stocks deserved a little flows in from bond selling but marginal.

Hedging

With most VIX tenors no where near extremes, and up from last summer’s lows it’s hard to see tons of vol decay coming into the market here. If anything, given earnings, Trump uncertainty, and seasonality one could argue to expect bearish hedging flows over the next few months.

The below shows the only periods I could I find of supportive option flows matched with declining price. One does need to consider that since the mid October high we’ve had a ton of vol decay, a Trump tailwind, retail mania, record inflows, and supportive option buying yet we’re +1%. WHO are the (likely big) sellers counteracting all that?

CTAs, Vol Control Funds

With up trends LONG established it’s hard to see trend following funds piling in here. The Vol control crowd are likely taking $ off the table in masse as the 1-month vol is above 3-month vol (realized) and is at levels only recently eclipsed by Oct 23 and Aug 24.

Wrap-Up

When they year starts like the below, is it not clear how most are feeling?

But as we learned last year, things can continue on longer than one would expect. And despite some mediocre “number go up” the last 2 or 3 months I’m sure the microstrategy, fartcoins and teslas of the world going ape on Friday gave many degenerates their much needed shot of hopium after a Santa Rally that was all coal and sticks; Though from a fundamental and TA perspective not much changed.

Obviously most are still all bulled up on equities, mainly US large caps, but with the Fed kaiboshing 2025 rate cuts (at least they say) and interest rates remaining lofty it’s hard to understand the bull case right here beyond….AI!

After the past two years I understand why me viewing any scenario as a spot the market may roll over as fool hearty BUT my whole investing philosiphy is that markets tend to outdue the underlying and unorthodox forces can put prices where they want stay for long….until they revert closer to reality.

Right now we have an economy that’s throughing off more recession signals (empirically and logically) ex-Covid since 2008, while equities are at nose-bleed levels. That is a BIG divergence to reconcile, and I imagine it happens in a bit of a hurry. So, as much as I hate it, I have to give creedence to a market that looks to be stalling out in the face of much uncertainty and unfavorable seasons (not to mention tax payment selling b/w now and April and a lack of buy-backs post quarter end).

And not to forget the SPX bouncing off two LONG term overhead lines in Nov and Dec…

We’ll see, 1st REAL week of the year this year with lots of economic data and the all important UE rate on the menu (will we see the dropping of all those election related jobs in the 16 to 19 age group from September?). Enjoy.

Cheers!

Current Positions & Stops

Short some SPY with a stop at 595 (Dec 23 weekly open).

Long some OTM Jun 2025 SPY Puts. Would sell half on a 6month VIX spike to 30-35 and look to re-enter once things “calmed” a bit. Otherwise, would have to respect a new ATH, and would look to systematically sell on whay down a more reasonable FWD PE multiples (18, 17, 16 etc).

Long TSLA OTM March Puts because why not? Can that delusion get anymore grande? And IMO him and Trump break up soon and only one loses from that.

Longer term stuff sitting in 30Y TIPS, which are an absolute steal if you don’t need the money in the short term.

Potential Trades & Entries

I’d love to have something that would trigger me long stocks here, but we just haven’t fallen enough to get a real bounce and the upside seems too limited.

I think Oil has some potential on techincals and sentiment, but nothing I’m ready to touch.

USTs (10 years or so) seem like something with potential once price action confirms (likely if people get recession fever again)

Disclaimer:

The above are the musings of an unqualified, non-financial professional. DO NOT treat it as financial advice. Do your own research, you’ll look like an idiot if you try to blame me, I’m Leonard.

Solid stuff, learning a lot from your writings and posts. Learning what to watch and to stay grounded.